Overview

The Organization Accounting Default document is used to define billing organization accounting line defaults for the Customer Invoice and Customer Invoice Writeoff documents.

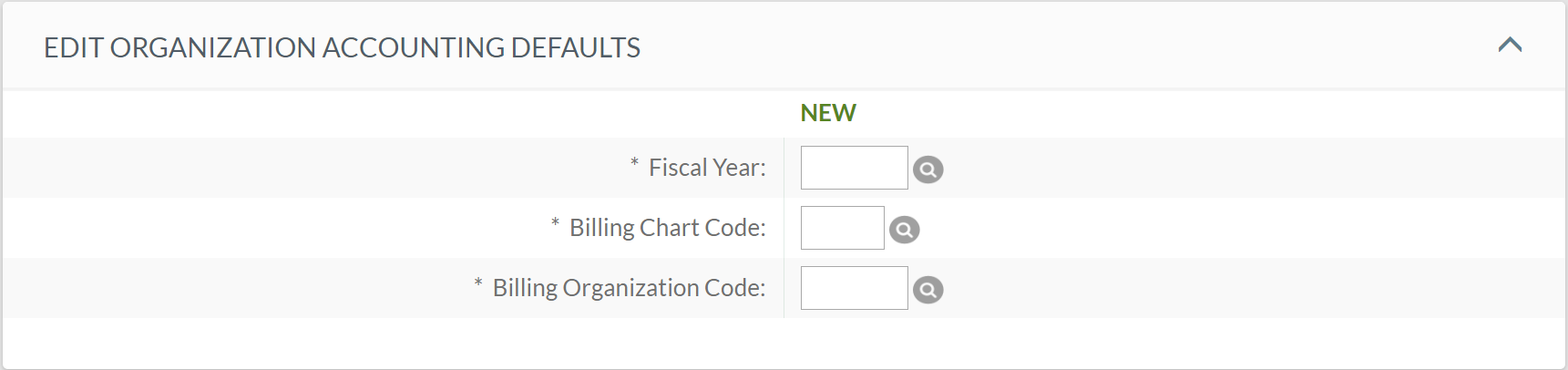

Organization Accounting Defaults

The Organization Accounting Defaults identifies the owner of the Organization Accounting Default by identifying the Billing Organization. Because there are object codes associated with this document, the Fiscal Year is also required.

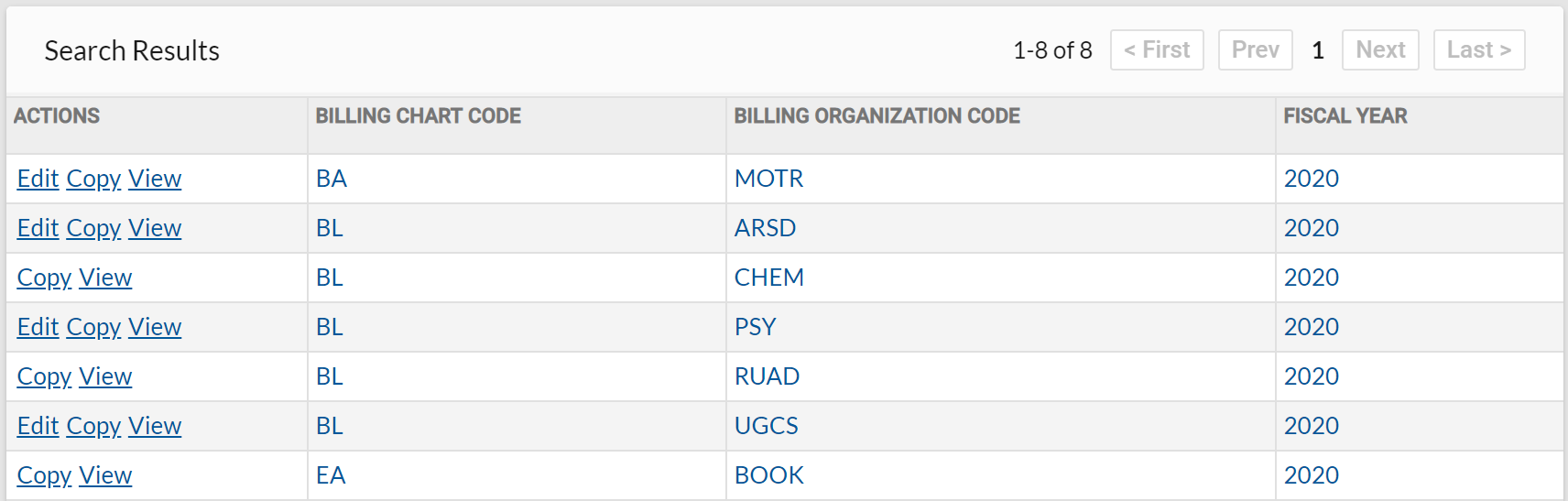

Users whose primary department or qualified AR department match this Billing Org, or associated Processing Org, can edit this Organization Accounting Default.

Following is what a user whose primary department is UA-VPIT will see when using the Organization Accounting Default lookup. UA-VPIT is a Processing Organization, so she can edit all defaults that belong to this Processing Organization.

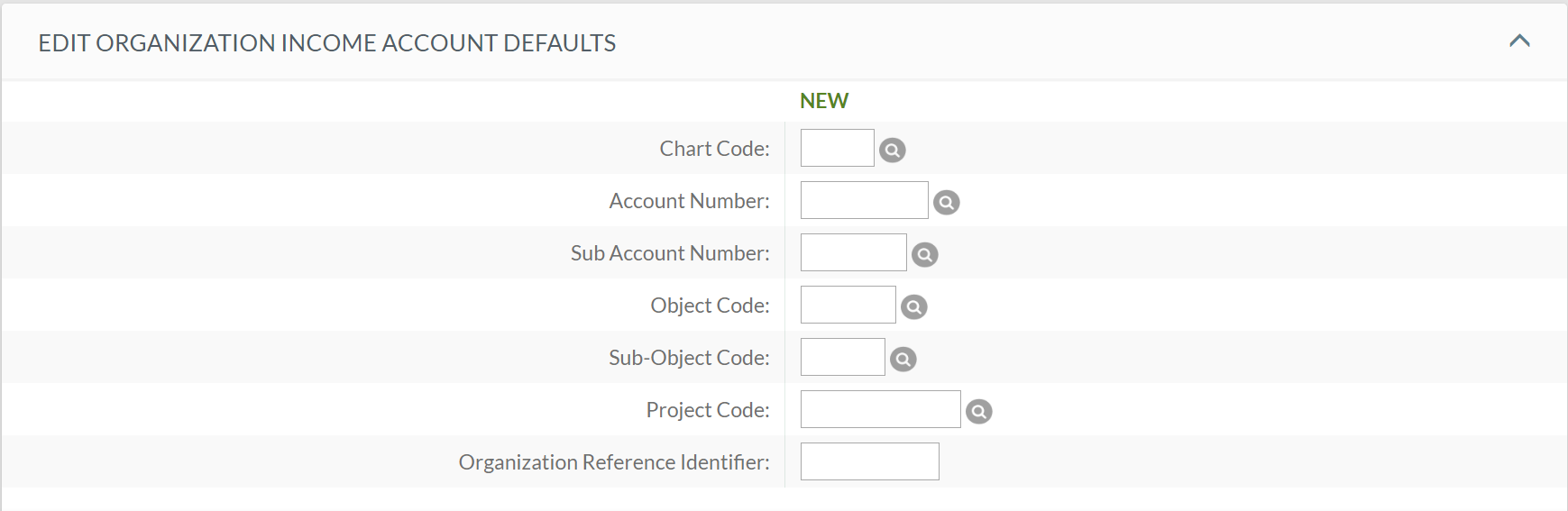

Organization Income Account Defaults

Specify the default accounting information that will fill in when a user with this primary department or qualified AR department initiates a Customer Invoice.

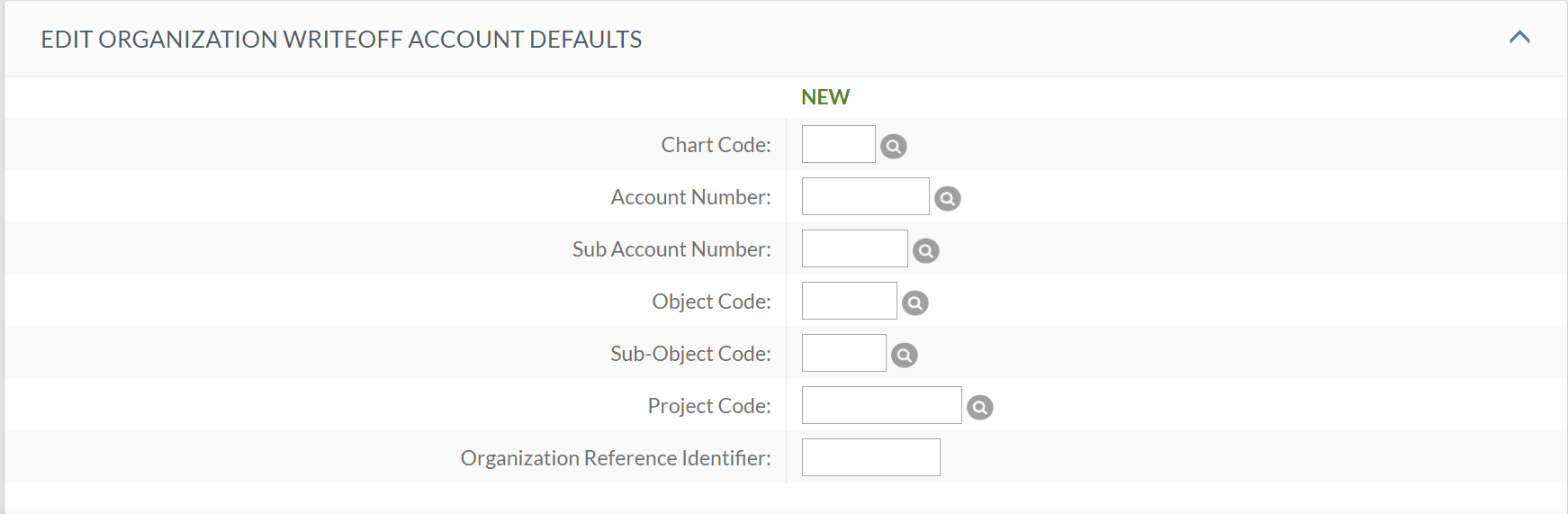

Organization Writeoff Account Defaults

Specify the default accounting information that will be used by the Invoice Writeoff process when parameter GLPE_WRITEOFF_GENERATION_METHOD = 2. Refer to the Invoice Writeoff article for additional information.

Comments

0 comments

Please sign in to leave a comment.