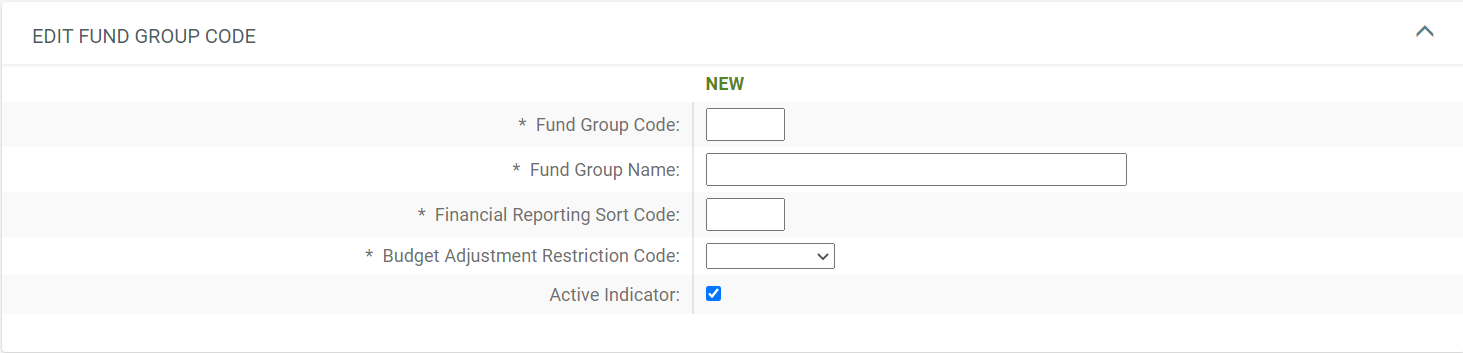

Fund Group

Fund Group defines the broadest category of sources of funds and is used for reporting and business rules. Examples of fund groups include General Funds, Contracts and Grants Funds, Operating, Non-Operating, etc. Fund group is an attribute of sub-fund. Sub funds are assigned to Accounts and from that sub-fund, fund group is derived. Sub-Funds are also used for reporting and business rules.

Most fields on this document are self-explanatory, those needing additional explanation are described below.

- Financial Reporting Sort Code : Used for reporting only to control the order of fund groups on reports.

- Budget Adjustment Restriction Code: Is used to define the level at which business rules on the budget adjustment document are checked. Refer to Budget Adjustment and Year End Budget Adjustment for additional information on this code.

- F - Fund: Budget transfers cannot be made between different fund groups.

- C - Chart: Budget transfers cannot be made between different charts.

- O - Organization: Budget transfers cannot be made between different organizaitons.

- A - Account: Budget transfers cannot be made between different accounts.

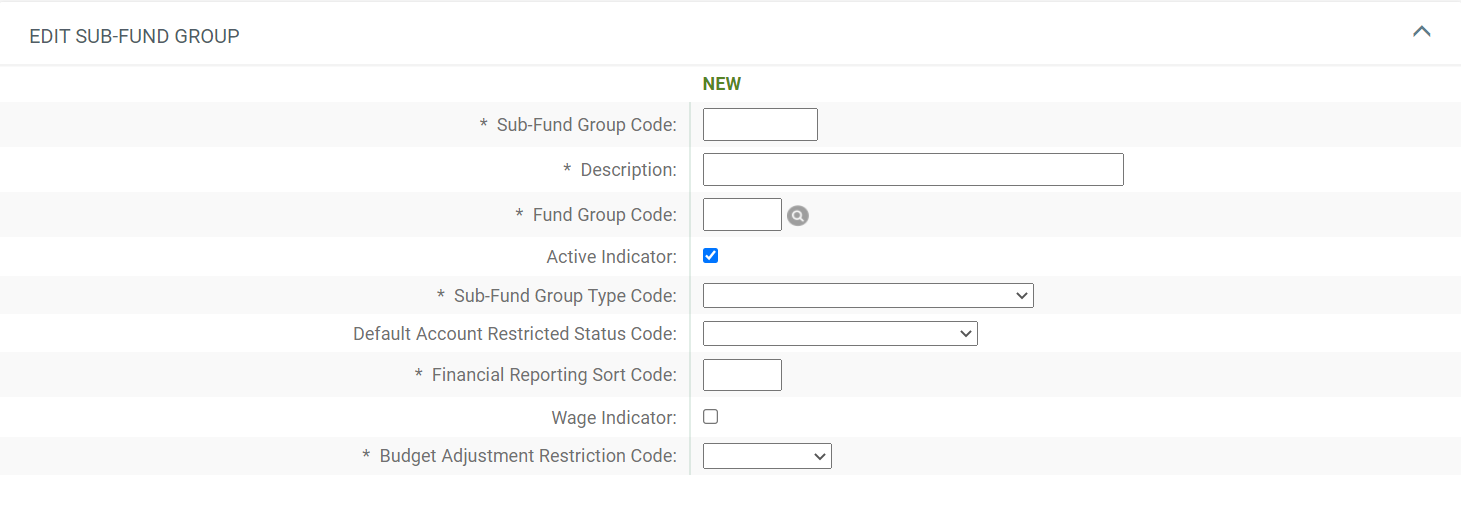

Sub-Fund Group

The Sub-Fund Group defines the type, purpose or source of funds for an account. Sub-fund group is used for reporting and business rules.

Most fields on this document are self-explanatory, those needing additional explanation are described below.

- Sub Fund Group Type Code: A code that identifies the sub-fund group type. Examples include:

Auxiliary, Internal Service Organizations, or Neither. Sub fund group types can be used in Contracts & Grants Invoice to determine the appropriate revenue and receivable object code. Use the Sub Fund Group Type Code lookup and maintenance document to manage valid values. - Default Account Restricted Status Code: Identifies a default restricted status code for accounts using this sub-fund group.

-

Financial Reporting Sort Code : Used for reporting only to control the order of sub fund groups on reports.

- Wage Indicator: Indicates if salaries and wages can be paid on accounts with this sub-fund group.

- Budget Adjustment Restriction Code: Is used to define the level at which business rules on the budget adjustment document are checked. Refer to Budget Adjustment and Year End Budget Adjustment for additional information on this code.

- N - None: There is no restriction of budget transfers.

- S - Sub-Fund: Budget transfers cannot be made between different sub fund groups.

- C - Chart: Budget transfers cannot be made between different charts.

- O - Organization: Budget transfers cannot be made between different organizaitons.

- A - Account: Budget transfers cannot be made between different accounts.

Comments

0 comments

Please sign in to leave a comment.