Overview

The Adjustment/Accrual Voucher (AV) document records adjustment, accrual and recode entries. It is used to record entries to the proper posting period of the transaction for preparation of accurate and timely financial reports. Postings are allowed to the open periods that are set by your institution.

The AV document consists of three separate document types:

- Adjustment: The Adjustment type (AVAD) is used to post adjusting entries that do not reverse in the following month to the General Ledger. The offset to these entries is to the fund balance if the entry affects more than one account. If the entry affects only one account, then there is no offset. Adjusting entries are made to recognize revenues in the period in which they are earned, and expenses in the period they are incurred. A reversal date is not allowed for this type.

- Accrual: The Accrual type (AVAE) is used to post accrual entries to the General Ledger that must be reversed in a designated month following the posting period. A reversal date is required for this type of AV, which is normally during the next fiscal period, although it may be later. The offset to these entries are to the fund balance object code if the entry affects more than one account. If the entry affects only one account, then there is no offset. An accrual entry is always used to correct an accrual entry.

Adjustment/Accrual Vouchers route to the Fiscal Officer or Delegate assigned to the accounts used on the document and optionally route to Organization Review and Object Code Review.

Fiscal Period Dropdown

Prior active periods will display in the Fiscal Period dropdown as long they are within the number of days specified in the GRACE_PERIOD parameter.

Users assigned to roles with the Edit Accounting Period permission can change the accounting period.

Adjustment

Adjustments are typically made for prior periods. Following is an adjustment made in November for expenses incurred in October and later paid in November. There is no Reversal Date and the entries that are created will post in the prior period as long as it is open. IN object types are changed to IC (income not cash) and EX object types are changed to ES (expenditure not cash). If the accounts had been different, offset entries would have posted to Fund Balance as defined in the Offset Definition table for AVAD.

General Ledger Pending Entries

Accrual

Use the Accrual option to record income/expenses incurred in the current period that will not be paid/received until the following period.

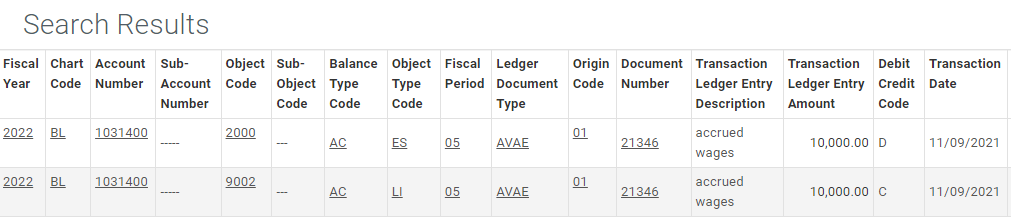

Following is an example of recording expenses in this period that will not be paid until next period. The accrual entries will reverse on the specified reversal date. Default reversal dates can be set in the Accounting Period table and changed as desired. Again, object types IN and EX will be changed to IS and ES respectively. If the accounts had been different, offset entries would have posted to Fund Balance as defined in the Offset Definition table for AVAE.

General Ledger Entries

Comments

0 comments

Please sign in to leave a comment.