Overview

The Asset Global (Add) allows you to:

- Create assets that are not purchased through the financial system, for example:

- Gifts

- Assets transferred-in from other agencies

- Found assets, for example, assets that were retired in error, or incorrectly classified in a prior fiscal year

- Non-movable assets which are added initially by the Asset Global (Add) document. Subsequent payments are added using the Asset Manual Payment (MPAY)

- Non-capital assets which are below the threshold defined by parameter CAPITALIZATION_LIMIT_AMOUNT.

- Recreate assets where the title of an asset has moved from federally owned to university or institutional owned. In this case, the original federally owned asset is retired, and a new asset is created using the Asset Global document. The re-created asset is normally re-created at the book or fair market value.

- Create assets from transactions fed in through cabExtractJob Refer to Asset Processing General Ledger and Accounts Payable

Asset Acquisition Type Lookup

When using the Asset Global (Add) to manually add an asset, you have to first select the Asset Acquisition Type. These values are maintained using the Asset Acquisition Type table. The values that have an Income Asset Object Code will create General Ledger Entries.

- Asset Acquisition Types in parameters PRE_TAGGING_ACQUISITION_CODE and ACQUISITION_TYPE (Component: Asset Fabrication) will not display in the Asset Type Lookup.

- Users in the KFS-SYS Asset Manager, KFS-SYS Asset Processor, or KFS Plant Fund accountant roles can

- create assets using the Acquisition Type in parameter NEW_ACQUISITION_CODE and

- non-capital assets, assets below the capitalization threshold defined in parameter CAPITALIZATION_LIMIT_AMOUNT and Asset Statuses not in parameter CAPITAL_ASSET_STATUS_CODES, that need to be inventoried

Accounting Period

When the Asset Global Add (AA) is included in parameter FISCAL_PERIOD_DOCUMENT_TYPES the Accounting Period tab will display. This tab is used primarily at year end to control in which year and period entries post. Permission Edit Accounting Period controls who can change the Accounting Period.

Asset Acquisition Type

Displays the value selected from the Asset Acquisition Type page.

Asset Detail Information Tab

Most fields on this tab are self explanatory, those requiring additional information are described below:

- Organization Owner Chart of Accounts Code and Account Number: identifies ownership for the physical inventory of the asset. This could be different from the account that paid for the asset in Add Payments tab.

- Owner: Is used with other owned property and can be completed from the Owner lookup which goes to the Customer or left blank to indicate University Owned.

-

Asset Status Code: Identifies the current status of the asset, there are business rules around transitioning assets from one status to another.

- None of the retirement asset status codes defined in parameter RETIRED_STATUS_CODES may be used on Asset Global.

- Asset Status Codes specified in parameter CAPITAL_ASSET_STATUS_CODES are considered capital assets and the cost of the asset must be greater than the amount specified in parameter CAPITALIZATION_LIMIT_AMOUNT.

- Parameter VALID_ASSET_STATUSES determines allowable Asset Status and Acquisition Type Code combinations.

- Vendor Name: Required for capital assets; optional for non-capital assets. Enter the name of the company or person who sold the asset to the institution and to whom the first payment was made.

- Asset Type Code: Enter the code used to classify types of assets grouped by categories or search for this code from the Asset Type lookup icon. The asset type groups equipment for reporting purposes. For capital assets, this code also assigns the useful life for depreciation purposes. For more information refer to Capital Asset Depreciation.

- Vendor Name: The name of the company or person who sold the asset to the institution and to whom the first payment was made. Required when parameter VENDOR_REQUIRED_IND = Y.

- Manufacturer: Enter the name of the person or company that manufactured the asset. Required when parameter MANUFACTURER_REQUIRED_IND = Y.

- Model Number: Optional. Enter the number assigned by the manufacturer to this model of asset.

- Last Inventory Date: Defaults to today's date and cannot be changed.

- Create Date: Date the asset was created, the In-Service Date will be set to this date.

- In-Service Date: Defaults to the Create Date.

- Depreciation Date: If the Object Sub Type is in the Asset Depreciation Convention table, the Depreciation Date will be set to 01/01 for HY (Half Year) assets and 07/01 for FY (Full Year) assets. If the object sub type is not in the table, the Depreciation Date will be the same as the Create Date.

Location

The Location tab allows you to create a specified number of assets at a given location.

The asset category identified by the asset type determines whether a building code, room number or off-campus information is required. For this reason the asset type must be specified before the building and room number are entered.

- The asset status is used to define whether the asset is capital or non-capital.

- If the Asset Status Code is not in CAPITAL_ASSET_STATUS_CODES, the asset is considered non-capital AND

- VALID_ASSET_STATUSES - identifies non-capital based on Asset Status.

- The asset type code identifies the asset category. The Asset Type Code table has a required building indicator and a movable indicator.

- Any asset type code with the Moving Indicator checked requires a valid campus, building code and room number combination, or an off-campus address.

- Any asset type code with the Required Building Indicator checked requires a building code.

- Any asset type code with both Moving Indicator and Required Building Indicator unchecked require a campus code but no building or room number.

Once the Location information is added, an Asset Unique tab is added for each asset that is to be created, with an assigned Asset Number. Most fields are self explanatory, those needing additional explanation are described below:

- Organization Inventory Name: Used to facilitate inventory by providing a common name in addition to the formal equipment description that comes from the Purchase Order. For example, GMC FABRICATED ABC1234 WIDE BODY DUMP may have an organizational inventory name of Recycling Truck.

- Tag Number: Optional. The unique identification number issued by the University and affixed to the asset.

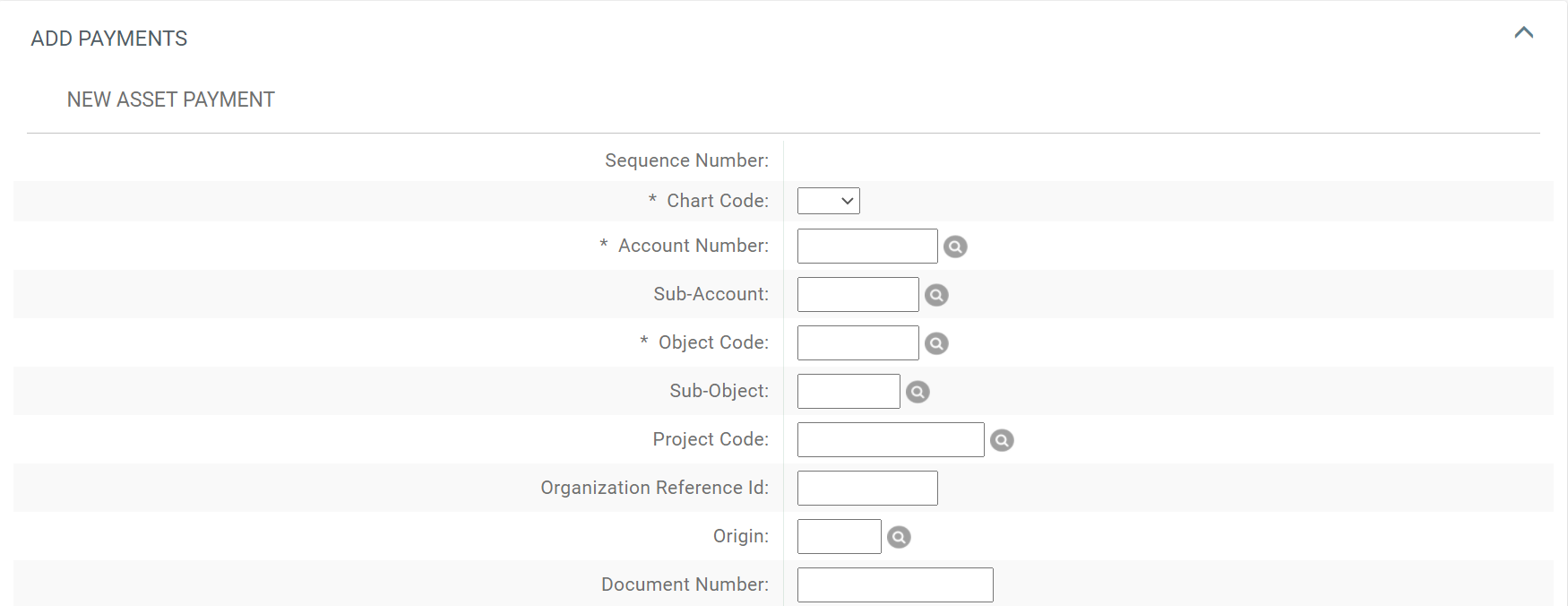

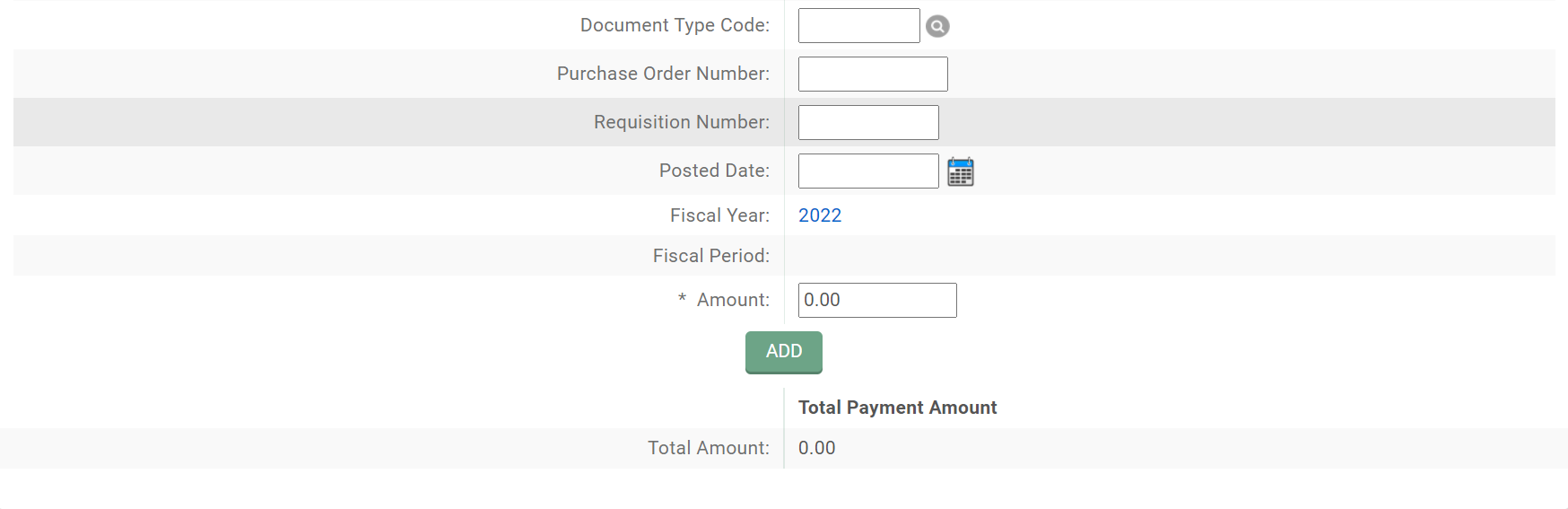

Add Payments

Payment information for non-capital equipment is optional. When you create a non-capital asset (see above - Location section), object sub-types defined by parameter INVALID_SUB_TYPES are not allowed.

When the asset payment information is fed into the document via Capital Asset Builder (CAB) all payment information is view only. Most fields are self explanatory, those requiring additional information are described below:

- Account Number: Enter the account number that was used to pay for or owns the asset or search for the number using the Account lookup icon. The account number in the Add Payments tab identifies accounts that contributed to the purchase of the asset. This number may differ from the one entered in the Asset Detail Information tab—a number that is used to identify ownership for the physical inventory of the asset.

- Object Code: Enter the object code that was used to record the asset payment or search for the code using the Object Code lookup icon. A warning will be returned if the Object Sub Types on the Payments are included in parameter PAYMENT_SUB_TYPES and the object sub type codes for each object code do not match. The Object Sub Type from the first payment will be added to the Asset Header. The Object Sub Type on the Asset Header is used by Depreciation to determine which accumulated deprecation and depreciation expense object codes from the Asset Object Code table to use when creating depreciation entries.

-

The following fields do not display and are system assigned when acquisitions types defined in parameter NON_PURCHASED_ACQUISITION_TYPES are used:

- Document Number is set to be the same as the Document Number of the Asset Global document.

- Document Type Code is set to AA for (Add)Asset Global document.

- Origination Code is set to 01, which indicates the transaction originated in Kuali Financials.

- Posted Date is set to the document approved date.

- The following fields display when acquisition types not defined in parameter NON_PURCHASED_ACQUISITION_TYPES are used:

- Document Number: Required when the acquisition type is New, parameter ASSET_PROCESSING_ACQUISITION_TYPE. Enter the document number or reference number used to purchase the asset. This number is not validated so that you can use a number from an external system.

- Document Type Code: must be a valid document type.

- Origination Code: Use 01 if the document number and document type originated from Kuali Financials; otherwise, use any valid code.

- Posted Date: set to the appropriate date, normally this would be the date the transaction referenced in Document Type and Number posted to the GL. This date drives the values in Fiscal Year and Fiscal Period. For more information refer to CAMS Date fields.

-

Amount: Enter the amount for the total number of assets paid for by this accounting string.

General Ledger Entries

General Ledger Entries

When an Acquisition Types with Income Object Codes are used, general ledger entries are created based on the account number used. The affected account will show offset entries to the expense object code entered on the document and an income object code assigned based on the Asset Acquisition Type Code entry. Line 1 was entered in the Add Payments; Line 2 was created based on the object code assigned to the selected Asset Acquisition Type code. When the entries post, the scrubberJob will create the appropriate Capitalization entries.

Routing

When the Asset Global (Add) is created from the dashboard link it will route to Fiscal Officer and Organization Review. If it is created using Asset Processing General Ledger or Asset Processing Accounts Payable, it will not route for approval.

Comments

0 comments

Please sign in to leave a comment.