Overview

Use this document to add additional payments to existing assets.

The Asset Manual Payment document can be accessed:

- directly from the dashboard

- the Asset Payment Lookup and

- when Apply Payment is used on the Asset Processing General Ledger / Accounts Payable screens.

The Asset Manual Payment document is used to:

- Apply payments to assets when transactions are extracted by the cabExtractJob from the General Ledger or when a Payment Request (PREQ) is created.

- Add payments to existing assets.

- Shift payments between assets.

The new payment is recorded on the asset and the total cost and base amount are updated for the asset. Entries to reverse accumulated depreciation will be created if a payment is entered to zero out an existing payment, otherwise, entries are not created.

In order to apply a payment, assets must be active. The asset status must be defined in parameter CAPITAL_ASSET_STATUS_CODES and not be in RETIRED_STATUS_CODES.

Asset Allocation Tab

Use this tab to specify how the accounting lines should be allocated to the selected assets. The Assets tab display will change based on the selection. Use the Select button to update the display if the Asset Allocation is changed after Accounting Lines have been added.

Assets Tab

Either enter and add asset numbers or use the Asset Number lookup icon to select and return multiple assets.

Fields and buttons on this tab are self-explanatory those needing explanation are described below:

- The Update View button updates the allocation in the In Process Payments by Asset tab if changes are made to the Asset Allocation selection or the accounting line amount.

- The New Total is the original cost plus the new payment amount. If the asset numbers are manually entered, the new total will not be updated until the new payment is entered and the Add button clicked to store the payment.

Following are the different Asset tabs based on the selected Asset Allocation:

-

Distribute cost by amount: Specify the amount to be allocated to each account.

- The Allocate Amount field displays

- The total of the Allocate Amount fields must equal the total of the accounting lines amount.

- The Allocate Amount must be greater that zero

-

Distribute cost evenly: The accounting line amounts will be distributed evenly to each asset.

- The Allocated amount displays and is read only

- The Allocated amount is updated as accounting lines are added

-

Distribute cost by total cost: The accounting line amount will be distributed based on the total cost of each asset.

- The Allocated amount displays and is read only

- The Allocated amount is updated as accounting lines are added

-

Distribute cost by percentage: Specify what percentage of the accounting line amount to apply to each asset.

- The Allocate Percentage field displays

- The total of all Allocate Percentage fields must equal 100

Clicking on the Asset Information tab in the Assets tab will display information about the Asset.

The Processed Payments tab will list all the payments for an asset up to 10, if there are more than 10 payments, the Processed Payments tab will not display and the Payments Lookup tab can be used to access the list of payments. The Click here link opens the Asset Payment lookup with the Asset Number field pre-populated with the asset number and lists all payments that have been processed on the selected asset.

When an Accounting Line is added an In Process Payments tab is added to each Asset Information tab.

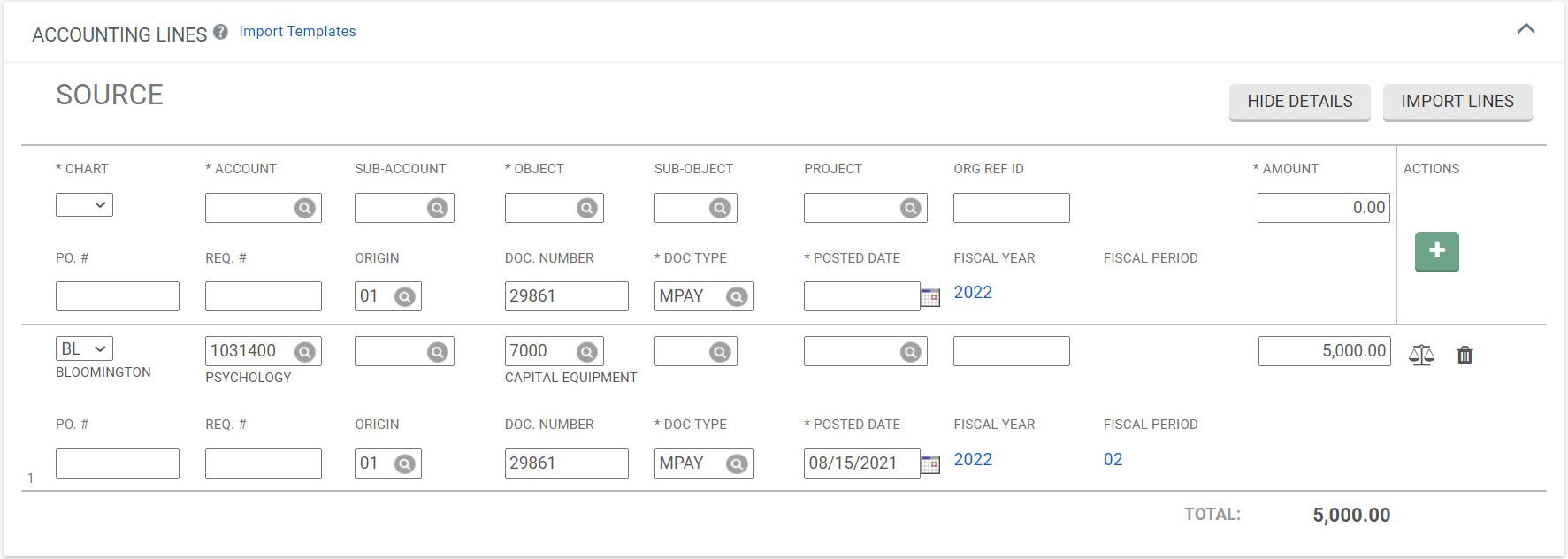

Accounting Lines Tab

The Accounting Lines tab allows the user to add new payment information for the assets. For manual payments, this information may either be entered here or imported. For transactions that originate from General Ledger Transactions and Purchasing / Accounts Payable Transactions lookup, accounting data is pre-populated and is view only.

Most of the fields in this tab are described in the Accounting Lines Tab article. Fields unique to this document are described below.

- PO # and Req #: Optional, enter the requisition and/or purchase order number used to purchase the asset. These values are not validated.

- Origin: Enter the code that indicates the source system of the payment transaction. When an accounting line is added, the Origin field is populated with 01, indicating the transaction originated from Kuali Financials.

- Doc Number and Doc Type: Defaults to the Asset Manual Payment document number and type and can be changed to a different number and/or doc type. Retaining MPAY information helps identify how the payment was added to the asset.

- Object Code: The Object Code must exist in the Asset Object Code table.

- Posted Date: Enter the date the capitalization transaction posted to the General Ledger so that the GL and CAM match. This date must be today or earlier. The Fiscal Period and Fiscal Year are set based on this date when the accounting line is added. Refer to CAMS Date fields for more information on how these dates are used in the system.

On submit, a warning is presented to the user if the object code used on the new payment is different than the object code of previously processed payments. When this warning is presented, the Object Sub Type on the Asset header should be reviewed to validate that it is correct. The Object Sub Type on the Asset Header is used by Depreciation to determine which accumulated deprecation and depreciation expense object codes from the Asset Object Code table to use when creating depreciation entries.

In Process Payments by Asset

The In Process Payments by Asset tab displays when an Accounting line has been added and will list each asset and the amount that will be allocated to it. The data in this tab is view only with the exception of the Look Up/Add Multiple Asset Payment Lines icon, described below.

Look Up/Add Multiple Asset Payment Lines

- Use this look up when the payment needs to zero out an existing payment. Clicking on the Lookup will take you to the Asset Payment Lookup and display payments that match on chart, account and object code where the Transfer Payment Code = N.

- Select and return the payments to offset the entered payment. The payments will be listed below the lookup icon with a Payment Sequence Number, Posted Date and Amount.

- When the document is submitted, if there are matching payments a warning displays.

- Click No to Continue if this is a new payment or if you have already selected payments.

- Click Yes to return to the Asset Manual Payment to look up payments if the new payment should zero an existing payment.

- The current period depreciation bucket of the original payment will be set to a negative amount of accumulated depreciation; the current period depreciation bucket of the new payment will be set to a positive amount of the accumulated depreciation from the original payment. The two buckets will zero each other out.

- The Transfer Payment Code will be set to Y on all linked payments to prevent future depreciation.

- General Ledger Pending Entries will be created to reverse accumulated depreciation.

Refer to MPAY Linking Payments for an example of using this feature.

Comments

0 comments

Please sign in to leave a comment.